Auto dealers play a pivotal role in facilitating the authorization of credit applications for buyers, making compliance a major mandate in their line of work. Of particular importance to auto dealers is compliance with regulations put forth by the Office of Foreign Assets Control (OFAC). These regulations target transactions that are prohibited for geopolitical reasons.

Auto dealers must navigate the process of providing lines of credit to prospective purchasers carefully so as to avoid invoking penalties for facilitating (even unknowingly) known enemies of the state as well as other organizations and individuals targeted by OFAC-overseen sanctions.

Penalties for noncompliance can be severe, ranging from exorbitant fines to imprisonment. Under the Trading With the Enemy Act (TWEA), such penalties include:

- Fines of up to $1 million for organizations

- Fines of up to $250,000 for individuals

- Imprisonment for up to 20 years

- Forfeiture of property, etc. related to any discovered violation

In the case of apparent violations discovered during an investigation by OFAC, the following actions may be taken:

- Civil monetary penalties (fines)

- “Criminal referral” or the act of referring the case to an appropriate law enforcement agency for further criminal investigation

- Denial, suspension, modification or complete revocation of licenses to engage in certain transactions

Further compounding the risks posed by the above penalties is the fact that subsequent violations often yield cumulative repercussions–fines for individual infringements are often stacked atop one another, resulting in dizzying liability. Maximum civil penalties for violations per statute covered by OFAC include the following:

- International Emergency Economic Powers Act (IEEPA)–The largest amount between $330,947 and 2x the original transaction

- Foreign Narcotics Kingpin Designation Act (FNKDA)–A total of $1,644,396

- Antiterrorism and Effective Death Penalty Act of 1996 (AEDPA)–The largest amount between $87,3614 and 2x what was required to retain possession or control

- Clean Diamond Trade Act (CDTA)–A total of $14,950

How OFAC Works

OFAC handles the creation and enforcement of trade sanctions intended to shut out certain countries and individuals from the financial system. Such sanctions target threats to the US and are often coordinated alongside other nations’ efforts.

Compliance with OFAC sanctions centers on screening for suspicious accounts and reporting them–ideally, before a transaction is processed. With that said, the actual implementation of a solid compliance program that keeps your company in the clear requires a bit of planning.

OFAC recommends that a risk-based sanctions compliance program be adopted in which 5 key factors are accounted for:

- Management commitment– Senior management within your dealership should support the program and allocate sufficient resources to it for it to be effective.

- Risk assessment– All potential threats to compliance should be assessed, including all touchpoints with the outside world. Newly onboarded customers should be assessed on a case-by-case basis to ensure they are not attempting to sidestep sanctions. This is where screening comes into play. Ideally, this process should be continuous.

- Internal controls– A strong policy should be drafted for identifying and handling prohibited transactions. Clarifying the way incidents should be reported as well as what records should be kept is crucial to making your compliance program work. It is also important that your internal tools and processes are capable of keeping up with rapidly shifting sanctions lists. Of note for OFAC compliance are both the List of Specially Designated Nationals and Blocked Persons as well as the Sectoral Sanctions Identification List.

- Testing and auditing– Regular audits help to ensure all aspects of your compliance program are as effective as ever. Specifying the manner in which you audit your systems and the schedule for doing so is vital to maintaining functioning compliance processes.

- Training-Training all employees who must interact directly with customers and facilitate transactions is a must to make your compliance program work over the long term.

Accommodating the above goes beyond preparing your company for potential probing from the OFAC, it effectively inoculates it against certain monetary penalties.

A particularly effective sanctions compliance program is viewed favorably by the OFAC and can lead to fines being waived and cases being regarded as less severe should actual violations somehow arise. Of course, running such a well-oiled compliance program is much easier said than done.

Pain Points for Dealerships

Keeping up with alterations to sanctions lists is difficult without the appropriate technical infrastructure and expertise. Handling such operations in-house is largely tangential to a dealership’s main business and can be costly.

In the event of a “hit” coming up, dealerships must contact the OFAC directly and provide the required information. Depending on the complexity of the transaction, handling reporting commitments can come at quite a cost in time and resources sometimes resulting in a net loss for the dealership.

A One-Stop-Shop Solution

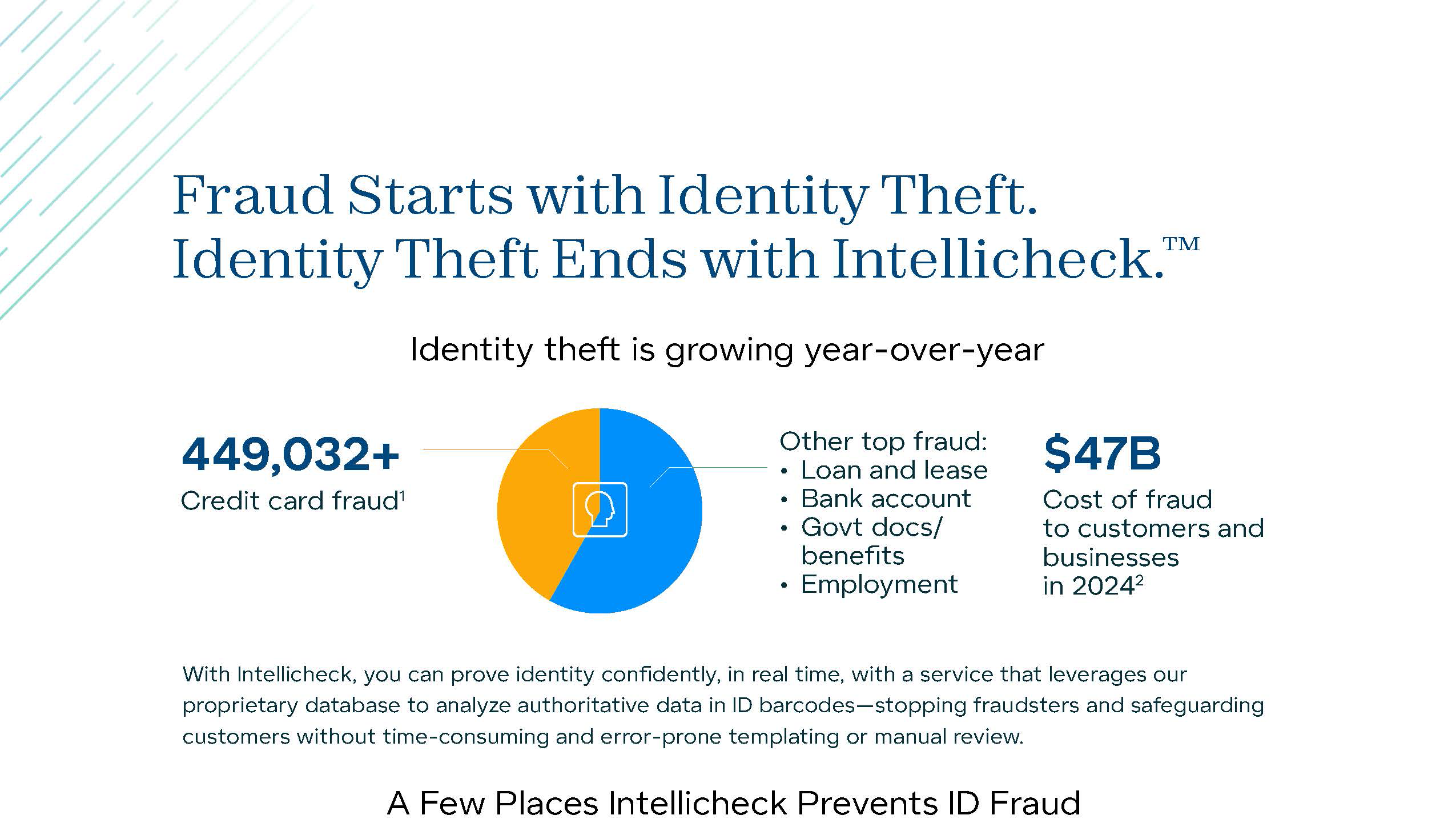

Instead of handling sanctions compliance on your own, it helps to adopt a comprehensive solution instead. Enter Intellicheck.

How it works

Intellicheck offers a feature-rich identity security platform with access to integrated OFAC screening that provides sanction and negative news screening designed to meet enterprise requirements. More than 1,500 global sanction lists (including those covered by the OFAC) help power Intellicheck’s risk-based security process.

Benefits of Intellicheck’s platform

By choosing Intellicheck’s platform, you gain access to identity risk scores that can be calculated on demand, allowing for questionable transactions to be canceled before they land your dealership in hot water with the OFAC.

Rather than investing in the creation of a time-consuming and costly compliance program, lean on Intellicheck–quick, simple, accurate.

Access this Resource

Related resources

Webinar

Intellicheck CEO Bryan Lewis and Javelin Director Tracy Kitten discuss next-gen fraud and effective identity verification, two key subjects in our 2024 annual report, created in partnership with Javelin.

Webinar

Intellicheck CEO Bryan Lewis and Javelin Director Tracy Kitten discuss next-gen fraud and effective identity verification, two key subjects in our 2024 annual report, created in partnership with Javelin.