In the fight against money laundering, the Financial Crime Enforcement Network established the Bank Secrecy Act (BSA) of 1970 and several laws thereafter. Anti-Money Laundering (AML) training programs have since been created to ensure that companies understand and conform to these AML compliance laws and regulations.

These programs were originally built on four core pillars: the development of internal policies, procedures and controls, the designation of an AML program officer, relevant training of employees and independent training. A fifth pillar, due diligence, was added in 2018.

AML training programs are now one of the necessary steps toward securing AML compliance. Here are a few things to keep in mind during the training process:

AML Training Timelines

In order to ensure your business is consistently staying AML compliant, effective AML training must occur at multiple points in time for employees at varying levels. There are essentially 3 different cadences in which AML training will need to be instituted:

- At employee onboarding: Walk new employees through AML compliance precautions and make sure they are clear on the significant efforts your company is taking to prevent AML violations.

- Any time major changes are made to AML compliance guidelines: the most recent changes include the fifth pillar of AML training programs in particular but can also include ways in which the company itself is adhering to AML laws.

- Periodic check-ins: It’s important to make sure each employee’s respective AML training is executed in practice. The practice itself, as opposed to simply the training, is what can ultimately make or break the general AML compliance of a business.

While the ‘when’ of AML training efforts are essential for a business to understand, the ‘who’ is just as crucial.

Degrees of Training Depth

AML training is required at all levels of financial institutions. For some, that training is more or less critical to the survival of the company, which is reflected respectively in the depth of AML training. Higher-ranking employees will be held to a higher standard and are more likely to receive harsh punishments for violating AML compliance.

It’s an AML/BSA officer’s duty to stay up to date on all changes to AML compliance which would mean a more in-depth and continued education process. Because of this involved and multi-layered process, it may be a good idea to seek out an AML training consultant to assist your business in understanding the many nuances of AML laws.

Consult Outside Training

Even with a BSA officer coaching your company’s employees through the AML compliance processes, you may need to rely on outside AML training teams to stay on top of guidelines. If your business is in need of outside assistance, here are a few AML training solutions you might consider:

- SIRS: At just $12 a course, SIRS’ beginner’s AML training covers an explanation of money laundering, a review of BSA/AML regulations, money laundering risks and red flags, appropriate action when encountering suspicious activity, and regulatory enforcement actions.

- RegEd: RegEd’s streamlined user experience ensures professional AML training with ease and also allows for administrator monitoring through their enterprise reporting capabilities.

- Quest CE: Between securities fraud to the detection and prevention of terrorist financing, the courses within Quest CE’s extensive AML catalog range various difficulty levels to suit each team’s needs.

Additional training, outside of the already required AML/BSA officer, is just one of the many tools that responsible financial institutions often utilize to guarantee AML compliance.

Make Sure Employees Are Using AML Tools

While your business may require self-guided programs or external AML training, money laundering cannot necessarily be prevented with the human eye alone, regardless of the amount of training. Other AML compliance tools, like AML software, can be used to automatically report suspicious activities.

There are four principal categories of AML software: transaction monitoring systems, currency transaction reporting systems, customer identity management systems, and compliance management software.

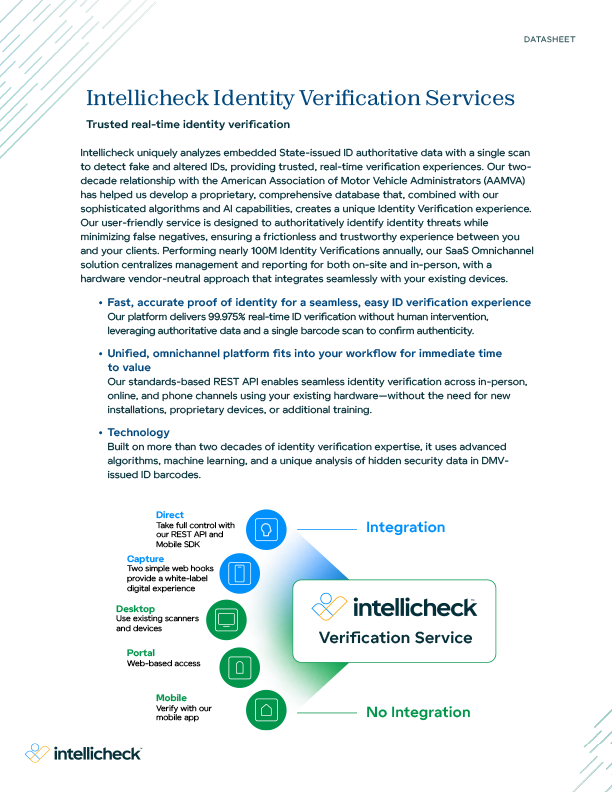

In particular, identity verification systems, such as Intellicheck, can be the best way to prevent fraud in real time.

Intellicheck Is Your Best Bet

There are multiple AML compliance issues that can arise daily, so it’s crucial to have a well-prepared team. The most effective way to fight against potential financial crime is to equip your business with Intellicheck’s identity authentication services.

With 99% accuracy, Intellicheck is the superior fraud prevention software for checking and authenticating IDs and is a failsafe addition that will only bolster your AML training and certification.

Access this Resource

Related resources

Podcast

Discover how identity theft costs businesses $15.6 billion annually and why credit unions face 11% revenue losses from account takeovers. Intellicheck VP Sandra Bauer reveals proven strategies for building customer trust through multi-layered identity verification, staff training, and transparent security communication.

Podcast

Discover how identity theft costs businesses $15.6 billion annually and why credit unions face 11% revenue losses from account takeovers. Intellicheck VP Sandra Bauer reveals proven strategies for building customer trust through multi-layered identity verification, staff training, and transparent security communication.