As consumers continue to move to online outlets, an inability to accommodate Know Your Customer (KYC) compliance regulations — whether intended or not — is a one-way ticket to hefty fines and a severely damaged reputation.

The risks associated with failing to properly handle KYC can often extend beyond the bounds of the financial industry as well, affecting organizations that leverage the services of companies in finance.

Ever since “Customer Identification Program” requirements were established for financial institutions in the U.S. in 2003 (stemming from the USA PATRIOT Act of 2001), KYC compliance has been important for understanding and mitigating risks resulting from serving an increasingly diverse range of clientele, both online and off. However, KYC has been around for far longer than many may realize.

What is Know Your Customer Compliance?

KYC compliance has existed in some form or another since 1970 as a part of a growing list of wider anti-money laundering requirements that financial institutions, in particular, have had to satisfy.

The Bank Secrecy Act of 1970 set forth some of the earliest requirements for financial organizations pertaining to recordkeeping and general reporting on transactions. Everything from the size of transactions conducted in the U.S. to their exact sources was to be reported from that point on, whenever transactions exceeded $10,000.

Additional laws joined the fray over the years, including those put forth in the Money Laundering Control Act and the Money Laundering Suppression Act. In a practical sense, KYC compliance is all about maintaining sufficient information on new and existing customers to identify risky accounts and transactions that could be related to money laundering, terrorist funding, etc.

Due diligence forms the foundation for all KYC compliance efforts, although there is plenty of variation that makes up the specific process used by each financial institution.

How Can I Improve My KYC Compliance Process?

Improving your KYC compliance process comes down to establishing a solid workflow that can be tapped into across your organization and a commitment to making adjustments over time as needs shift and legal requirements develop.

You can begin taking appropriate action to improve your KYC compliance process right now by implementing the following:

Require the Same Process for Everyone

No matter who your organization is dealing with, the process for KYC compliance should be conducted in the same manner. Whether customers are new to your organization or have a history with it already, the standards you have in place for processing their transactions should be upheld, as should those intended to maintain up-to-date records of their identities.

Doing this appropriately can often be seen as a major challenge for financial institutions looking to keep regulators and customers happy, especially when such practices appear to conflict with customer interests and preferences. Using better technology and existing information to handle critical facets of your KYC compliance process can go a long way toward streamlining customer interactions across the board.

Utilize High-Quality Identity Validation

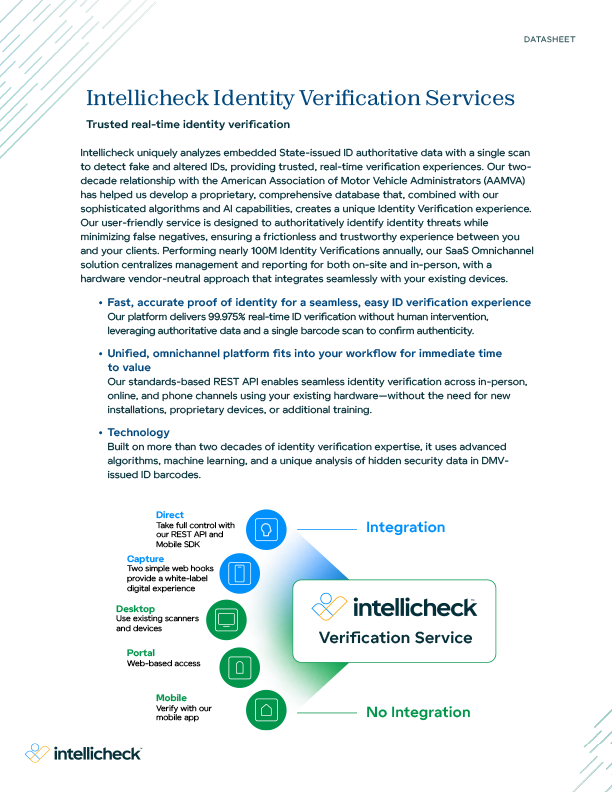

Where human intervention in processes such as this often leaves the door open for bad actors to slip through undetected, powerful identity validation solutions consistently deliver. Solutions such as Intellicheck ensure ID validation results are accurate enough to count on.

Continuously Monitor

Customers must be monitored continuously on the basis of their activity and the accounts they transact with in order for your compliance program to have teeth. Effective monitoring involves establishing reasonable thresholds for account activity with legal foundations that ensure your organization is not inadvertently letting fraudulent transactions take place.

Unusual account activity may merit a report to authorities, and it is only truly identifiable through consistent monitoring.

Remain Compliant

KYC compliance is no small task. The amount of time and effort that must be directed towards adhering to applicable laws in the financial sector can be offset with either costly staffing measures, which can often fail due to human errors, or forward-thinking solution adoption strategies, which can be incredibly fast and effective.

Proven solutions afford your company the opportunity to improve throughput and enhance compliance processing accuracy, while potentially driving down staffing costs at the same time. Intellicheck offers proven solutions you can trust to get the job done at scale.

Intellicheck’s ID validation solution delivers on accuracy with an industry-leading 99.9% success rate. You can leverage Intellicheck’s subsecond results to provide customers with a vastly simplified onboarding process as well as inherently fewer error-prone results, requiring fewer direct interactions to obtain.

Intellicheck’s solution can be up and running in no time at all with its turnkey web portal or seamlessly integrated into your existing system via a full-featured API. Choosing Intellicheck’s identity validation means choosing a solution that even law enforcement agencies across the nation have come to trust.

.png)