The landscape of fraud has rapidly transformed in the last few years, and it’s increasing in scope thanks to the evolution of payment apps and the reach of the internet. In 2021 alone, the financial platform, Cash App, saw triple the fraud compared to years prior.

This is a trend that will become more common if both companies and consumers don’t start taking proactive steps to mitigate the risk of fraud.

An Increase in Synthetic Identities

Synthetic identities are created by mixing real identifiable information with fake details to create a compelling forgery. Ample access to private information provides fraudsters with leverage and more avenues to get their way. By the time the fraud is discovered, the damage has often already been done.

A Broader Landscape

A growing variety of high-ticket items have been made more accessible to the public by way of special, limited lines of credit. These lines of credit are available on demand at the point of sale. One example is buy now, pay later (BNPL).

Extremely low (or absolutely zero) interest rates and less oversight (no credit checks) make such financing options highly attractive to shoppers. Unfortunately, this also creates opportunities for bad actors.

Forged identities can confuse companies trying to track outstanding lines of credit, and outright stolen identity documents can offload the implications of missed payments onto unwitting victims.

Younger Generations at Risk

Increased purchases by Millenials and Gen Z across an ever wider range of platforms — social media, digital wallets, and peer-to-peer apps — make them even more vulnerable to fraud.

Credential Stuffing and More

Credential stuffing is an approach where a stolen credential is used across a variety of sites to see where it works. Almost no technical knowledge is needed to launch a credential stuffing attack and the necessary tools are easy to acquire, making this a popular choice for even the most novice scammers.

A Dictionary attack is a technique where a fraudster will try a variety of credentials at a single site to see what works. While the name implies going through every combination, fraudsters will often use it with the top 100 popular passwords and libraries of stolen passwords.

Advancing Tech

With the internet at the helm, technology continues to evolve relentlessly. As the Internet branches out into smart devices of all sorts, the potential for interference from fraudsters looms ever more ominously. The so-called Internet of Things (IoT) includes devices such as Amazon’s Alexa, which can send money using nothing but a voice command.

Everything from social engineering (simply tricking users into sending funds or information to a scammer) to IoT device hacks that compromise attached financial accounts has become accessible to fraudsters.

Mitigating the Risk

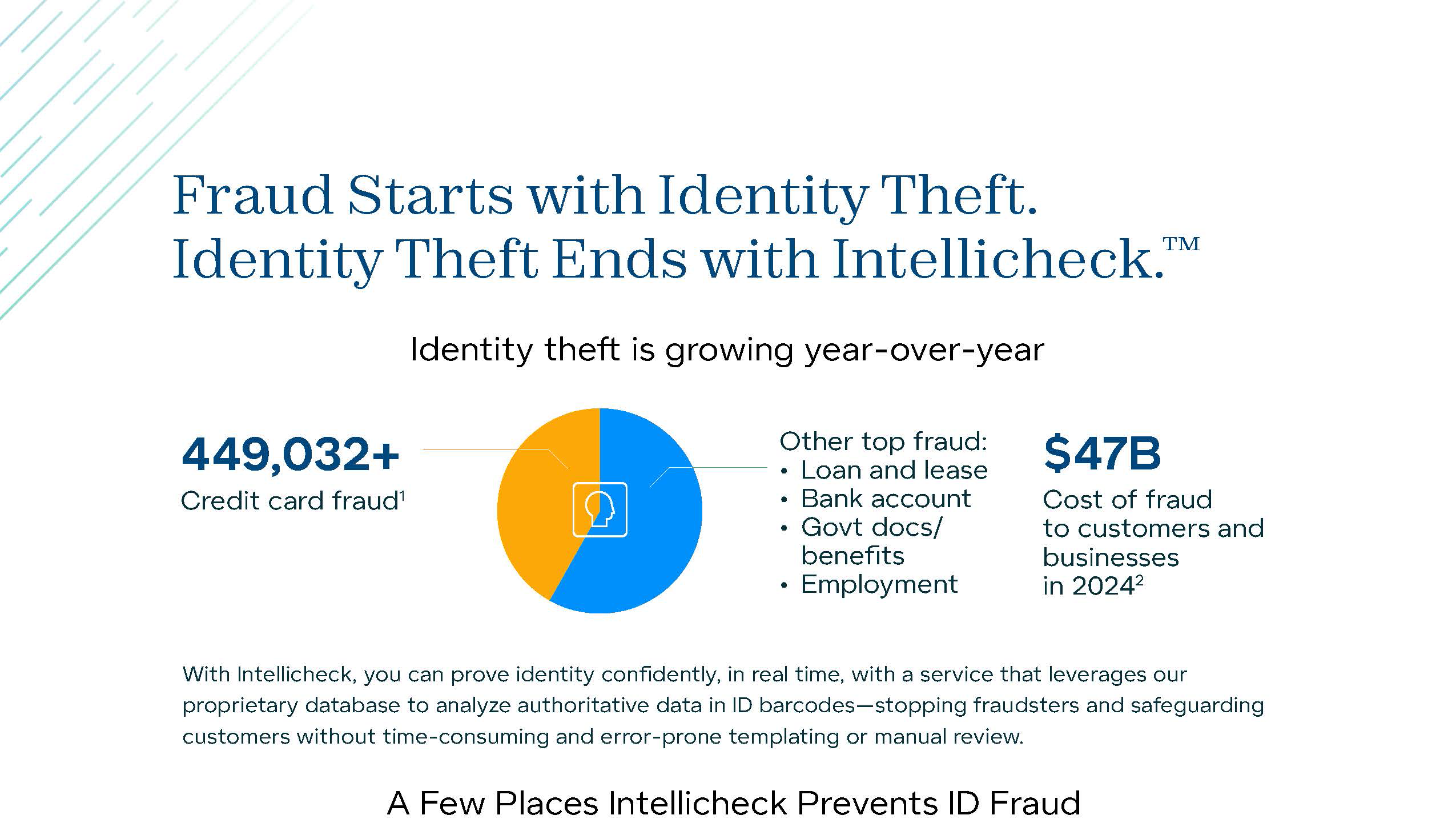

It is up to organizations — financial or otherwise — to provide the means for customers to transact safely and securely. Banks, e-commerce companies, and even brick-and-mortar stores will need to take appropriate steps in anticipation of the sudden spikes in fraud seen across so many industries in the last few years. Intellicheck can help.

Whether your business is entirely online or you need to verify IDs in person (or even a combination of the two), you can count on Intellicheck’s platform to provide subsecond results with 99.9% accuracy. The system can be used as a turnkey solution ready to go in under an hour, or as a fully customizable API-driven solution. It can be connected to your POS scanner or used with your existing mobile phone or tablet.

With Intellicheck, you can cut your fraud and keep your customers’ identities secure.

Access this Resource

Related resources

Blog

Cargo theft through truck driver impersonation is costing logistics and trucking companies billions annually. Learn how identity verification technology can protect your fleet and prevent fraudulent drivers from infiltrating your operations.

Blog

Cargo theft through truck driver impersonation is costing logistics and trucking companies billions annually. Learn how identity verification technology can protect your fleet and prevent fraudulent drivers from infiltrating your operations.

%20copy.webp)